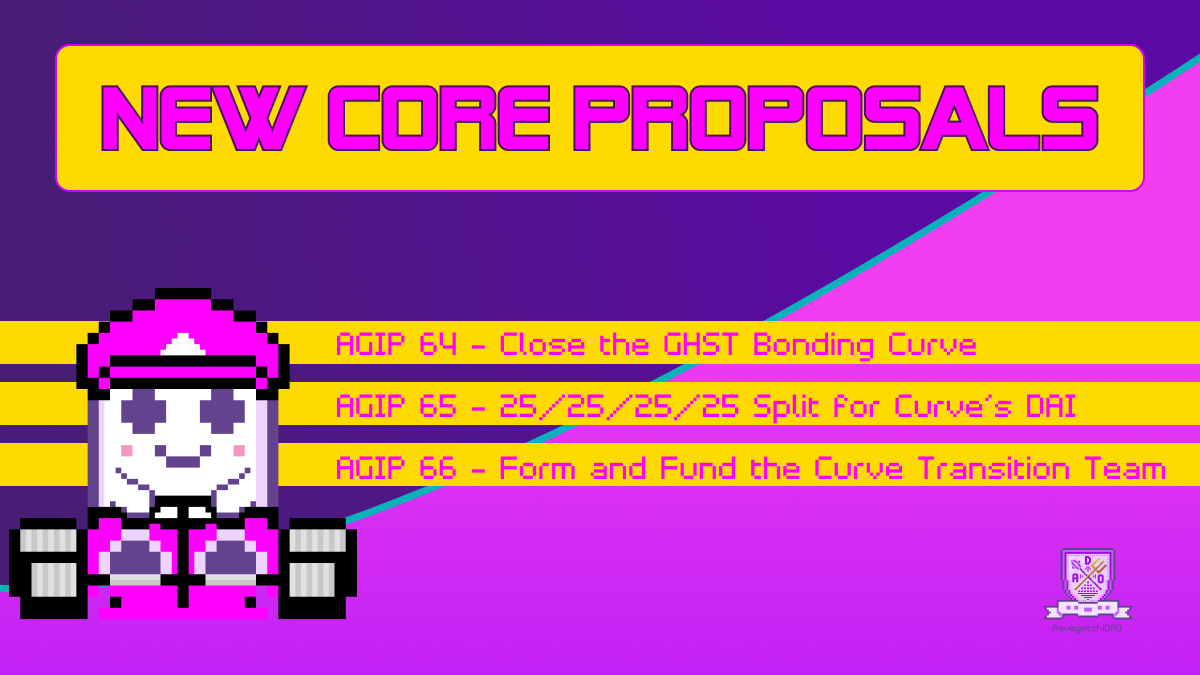

Three new Core Proposals are live for voting on the official Aavegotchi Snapshot: Close the GHST Bonding Curve, 25/25/25/25 Split for Curve DAI, and Form and Fund the Curve Transition Team. Keep reading to get the full scoop on each proposal, join the discussion on the official AavegotchiDAO forum, and then finally head into Snapshot to cast your vote!

Please examine each proposal carefully before voting. If a CoreProp reaches quorum, XP will be sent to all voting wallets’ Aavegotchis regardless of which side of the results one is on.

- AGIP 64 Discussion (Close the GHST Bonding Curve)

- AGIP 65 Discussion (25/25/25/25 Split for Curve DAI)

- AGIP 66 Discussion (Form and Fund the Curve Transition Team)

The votes for AGIP 64 and 65 are open until Saturday, February 26th and the vote for AGIP 66 is open until Monday, February 27th. This gives you plenty of time to consider, discuss and VOTE at the AavegotchiDAO Snapshot.

Now, let’s have a look at these three Core Proposals, shall we?

[AGIP 64] Close the GHST Bonding Curve

Author: Jesse | gldnXross#6482

GotchiID: 4563

Quorum requirement: 20% (9M)

Vote duration: 7 days

XP Reward: 20 XP for each Aavegotchi in the voter’s wallet

Final Discourse Thread: https://dao.aavegotchi.com/t/alternate-proposal-for-post-curve-allocation/4668

Original Discourse Thread: https://dao.aavegotchi.com/t/proposal-to-close-the-ghst-bonding-curve-and-allocate-curve-s-collateral/4628

INTRODUCTION

AavegotchiDAO was summoned as a 100% on-chain DAO in September 2020 via the deployment of the GHST Bonding Curve. This proposal is based on a diligent risk assessment of the Curve and concludes that there is a strong case for closing the GHST Bonding Curve and freeing GHST from reliance on MakerDAO’s DAI stable coin.

Closing the Curve in effect concludes a 2.5+ year DAICO (DAO+ICO) token sale. All DAI in the GHST Bonding Curve at the time of closing will transform the DAI from being half of a simple liquidity pool into actual Aavegotchi funding. A second Signal Proposal follows this one proposing a 30/30/40 split of the DAI for the founding team at Pixelcraft Studios, AavegotchiDAO treasury, and an additional 40% for the DAO that is explicitly earmarked for liquidity provisions.

The Problem: Unnecessary Risk Underpins Aavegotchi Today

“The Curve is forever” is a shorthand way of expressing how reliable GHST’s tokenomics have been up to this point. However, starting in 2022 turbulence in the macro crypto space has been growing, and our beloved bonding curve is potentially at risk of contagion.

While MakerDAO, the issuers of DAI, have delivered a stable stablecoin up to this point (DAI has never had a significant depeg from the USD) there is no guarantee that such success will continue indefinitely. Recent red flags include an inability for MakerDAO to remove the GUSD vault (a stablecoin issued by the recently bankrupt Genesis), the “Endgame” plan to depeg DAI from USD, growing exposure to real-world-assets (RWA) fraught with counterparty risk, and a general overexposure to (and vulnerability of) the USDC stablecoin in the MakerDAO asset pool.

Even if one concludes that DAI’s risk is only low to moderate, we must soberly assess whether such risk tolerance is acceptable to our DAO. Today, I put forth that not only is any risk from DAI’s depeg unacceptable, but such risk is also entirely avoidable.

Aavegotchi Is Ready to Secure Funds On Our Own

AavegotchiDAO has already demonstrated that it can manage its own treasury. Likewise, two plus years of Pixelcraft Studios flawlessly managing all significant ecosystem multisigs and upgradeable contracts underscores the company’s readiness to also manage the DAI at scale.

With nearly 20M DAI in the curve, there is sufficient funding to continue development and enable deep liquidity at the same time. The Curve was KYC’d and never accessible to a large swath of Aavegotchi fans. Under this proposal, GHST with good liquidity would actually become more accessible to more people!

It is along this backdrop of benefits including derisking, securing funding, and improving GHST accessibility that I propose closing the GHST Bonding Curve.

Allocation of the Curve’s DAI

Turning off the Curve is an opportunity to not only derisk from reliance on MakerDAO, but also secure significant funding for our ecosystems.

So far, the DAI in the Curve’s contracts has only served one purpose: to provide liquidity for the creation and destruction of GHST tokens. After the Curve’s closure, whatever DAI remains in that contract will be freed to go to work on behalf of the Aavegotchi protocol.

My originally paired Signal Proposal regarding allocation of DAI was voted down. However, another Signal Proposal written by Immaterial and Fantasma has passed with over 80% support. Titled “25/25/25/25 split for curve DAI”, that SigProp was upgraded to CoreProp shortly after the publishing of this proposal you are now reading.

IF the 25/25/25/25 CoreProp passes alongside this proposal to close the curve, then DAI post-Curve closure shall be allocated in accordance with it.

IF the 25/25/25/25 CoreProp does not pass, but this proposal to close the curve does pass, Curve’s on-chain vote on Aragon will not happen until a new CoreProp regarding DAI allocation is passed.

Process:

Assuming both CoreProps pass, the process for our community to close the GHST Bonding Curve will happen in a controlled, methodical way by following these steps:

Sunday, Feb 26

This CoreProp and a DAI distribution CoreProp must both pass in order to confirm AavegotchiDAO’s intention and terms. If passed, the Aragon on-chain vote to close the GHST Bonding Curve begins in the days following shortly after.

*Achieving quorum on our on-chain vote requires 8% of total GHST supply to participate. That means GHST holders need to coordinate migrating GHST back to Ethereum between now and the vote so that we can honor the AGIP and successfully close the Curve.

IF Aragon vote successfully closes the Curve:

The Curve will immediately close, capping the supply of GHST. Any DAI collateral shall be transferred to all multisig wallets in accordance with the terms of the 25/25/25/25 AGIP.

Risks

The risks of closing the Curve mostly are technical in nature. Pixelcraft Studios has already had our Solidity team spend time simulating the process for closing the Curve and how that would work. Everything worked as designed. The majority of risk is in the moments after the Curve closes.

Without deep liquidity and a spike in outside entities speculating, we may see dramatic volatility in the GHST market.

There is also a greater-than-zero risk for the new multisig wallets tasked with securing the DAI. With proper planning and for the reasons noted above, we believe that AavegotchiDAO is capable of this responsibility.

Benefits

The benefits and reasoning for this are already well fleshed out above but to briefly review:

Remove all risk of Aavegotchi’s success relying on an outside party (MakerDAO and DAI)

Complete the GHST continuous token sale, securing funding for both AavegotchiDAO and Pixelcraft Studios, thus enabling bigger, better, faster, stronger development for both parties.

Improve GHST tokenomics, especially in terms of accessibility. As opposed to having most liquidity locked into a KYC-walled liquidity pool, AavegotchiDAO will be able to dynamically direct liquidity to the platforms that make the most sense at any given time.

Conclusion

For the benefits noted above, I am proposing that now is the time to meet the moment and make this significant change to the Aavegotchi ecosystem’s meta. The status quo is simply unacceptable as the risk of doing nothing cannot be justified. Together we have weathered a brutal bear market in 2022 and now have an opportunity to prove we’ve learned lessons from watching seemingly invincible players in the space fall. Securing significant funding that is rightfully raised also makes a lot of sense given where we are as a protocol. The vision is too great for small budgets especially when the option to close the token sale and allocate those funds to the vision’s development is completely within AavegotchiDAO’s control.

We are in a completely unique situation where we can self-fund on a scale envious of our competitors, all while completely derisking from our current reliance on DAI tokens. Let's use this opportunity as a rallying cry to come together and level up as the completely independent, self sustaining AavegotchiDAO.

Option 1: YES, close the GHST Curve

Option 2: NO, do not close the GHST Curve

[AGIP 65] 25/25/25/25 Split for Curve DAI

Authors: Immaterial#0001, Fantasma#1777

GotchiID: 16559, 2824

Quorum requirement: 20% (9M)

Vote duration: 7 days

XP Reward: 20 XP for each Aavegotchi in the voter’s wallet

Discourse thread: https://dao.aavegotchi.com/t/even-allocation-of-curve-reserves-among-4-pillars-of-the-ecosystem/4664

Hello frens,

We would like to put forward our own proposal that we believe is the fairest way to allocate the funds whilst also protecting asset holders. We believe that the 4 pillars of the Aavegotchi ecosystem are: Liquidity, The DAO, Pixelcraft, and Asset holders. Therefore, our proposal is to allocate the curve funds evenly between these 4 pillars and making sure asset holders are not left behind by allocating them 25% of the DAI for Protocol Rewards which will directly reward asset holders through either Rarity Farming, or another reward mechanism chosen by the DAO.

The split would be as follows:

Liquidity: 25%

The DAO: 25%

Pixelcraft: 25%

Protocol rewards: 25%

By protocol rewards, we mean fair and inclusive reward pools that account for all native assets in the protocol. A yes vote for protocol rewards in this case does not mean a yes vote for ongoing RF in its current iteration, it protects funds to be used to make sure that protocol assets remain liquid and sufficiently included in the economic cycle/paradigm going forward.

A yes vote for protocol rewards signals to loyal supporters of the protocol that the original vision remains intact, rather than being diverted into new and unproven games and business models.

Without inclusion/correlation between GHST and assets, great economic disruption could follow the turning off of the curve for asset owners. A stream of funding protocol rewards for two years not only creates an ongoing source of buy side liquidity for the GHST token, it also allows market participants to trust in the correlation between GHST and protocol assets.

As we prepare to release the Forge and GBM different assets, we have the choice to signal to market participants whether they are bidding into a single RF season, or towards inclusion in the economic benefits of the platform for a full two years from here.

Thank you frens for your vote. For further discussion please head over to the forum thread linked below.

Option 1: Yes, agree to 25/25/25/25 split

Option 2: No, find another way

[AGIP 66] Form and Fund the Curve Transition Team

Authors: Dr Wagmi (Dr Wagmi#6629)

GotchiID: 16635

Quorum requirement: 20% (9M)

Vote duration: 7 days

XP Reward: 20 XP for each Aavegotchi in the voter’s wallet

Discourse thread: https://dao.aavegotchi.com/t/dao-curve-transition-team/4676

We propose the formation of a DAO Curve Transition Team (CTT) to assist the DAO in managing liquidity and treasury on a contingent basis prior to and after turning off the GHST curve should the DAO consent. We have numerous problems to tackle which need thoughtful investigation. The CTT will provide detailed summaries and analysis of our current state and potential paths moving forward regarding liquidity and asset management. These are some of the main questions the CTT will address and provide potential paths and analyses for DAO consideration:

Regarding liquidity:

Should current treasury assets be used to provide liquidity prior to the curve being turned off?

If so, how much? What wallet will hold these LP tokens? Will that liquidity remain after the curve DAI is distributed? Should the DAO stake those LP tokens for GLTR?

Should the DAO keep GHST-USDC as the primary liquidity pool? If supporting any secondary pools, where do we diversify out?

What is our goal amount of decentralized liquidity?

How does this compare to current liquidity? How fast should we seek to establish our goal amount?

What are potential estimations for impermanent loss with different potential trajectories for GHST?

Should we turn off GLTR rewards for amGHST and move them elsewhere?

Regarding treasury management:

What are our operations for treasury management?

What wallet is holding the funds?

Is our operational security process adequate?

Are we keeping funds in DAI or moving to alternative assets?

What other stablecoins would we consider?

What other crypto assets would we consider? ETH, BTC, MATIC? On what chain?

What DeFi protocols should we consider for treasury management?

Which ones should we meet with and what liquidity mining rewards should we aim for?

Should we perform GHST buybacks? If so, how? What are the potential impacts and costs of such a strategy at different liquidity targets?

What should be done with interest earned? GHST buybacks? Compounding into the asset earning interest?

To answer the above questions with sufficient market research, we propose a 10,000 GHST bounty. We aim to provide the DAO a complete analysis within 3 weeks with multiple potential paths for consideration. Efficient treasury management will provide yield to keep our operations sustainable while also directing liquidity to ensure decentralized access to our core product.

Option 1: Yes. Form and fund the CTT.

Option 2: No. Do not form or fun the CTT.

XP Reminder

Your participation in Aavegotchi governance is valuable to the project and to your own Aavegotchis! Each Aavegotchi you own will earn 20 XP for your voting in each individual CoreProp. That’s 60 XP total if each of these proposals meets quorum! The XP is airdropped directly to your Aavegotchis in the week or so following the conclusion of the vote.

Your Aavegotchis earn XP regardless of whether you vote for or against any particular proposal.

Conclusion

Make sure you join the discussion threads before voting, as it is very important to hear any concerns that are not addressed in the original verbatim proposals. Once you’ve heard from both the bulls and bears it’s time to put your voting power to use!

AGIP 64 Vote

AGIP 65 Vote

AGIP 66 Vote

Stay spooky frens,

Aavegotchi Team

About Aavegotchi

Aavegotchi is an open-source, community owned NFT gaming protocol, enabling true asset ownership for gamers. Aavegotchi NFTs are on-chain collectible ghosts staked with Aave’s interest-generating aTokens.

Compete for player rewards by earning XP, leveling up, and increasing the rarity of your Aavegotchi fren. Aavegotchi is governed by the AavegotchiDAO and the native eco-governance token GHST. Visit Aavegotchi.com today and join the future of DeFi-staked NFT avatars!

Aavegotchi Resources:

Website: https://aavegotchi.com/

Blog: https://blog.aavegotchi.com/

Official Wiki: https://wiki.aavegotchi.com/

Twitter: https://twitter.com/aavegotchi

Discord: https://discord.gg/aavegotchi

YouTube: https://www.youtube.com/c/Aavegotchi

Reddit: https://www.reddit.com/r/Aavegotchi/

Telegram: https://t.me/aavegotchi

Gotchiverse Resources:

Website: https://verse.aavegotchi.com/

Gotchiverse Docs: https://docs.gotchiverse.io/

Fake Gotchis Resources:

Website: https://www.fakegotchis.com/

Twitter: https://twitter.com/FAKEgotchis

Instagram: https://www.instagram.com/fakegotchis/